Blog

Plunge Guarantor Co-Signal Solution Put Solution

Content

For the latter, the house director accountant need to frequently display screen the brand new indices to adjust interest rates. The brand new management of these types of deposits, like the accrual interesting as well as payment, may vary significantly across says. Security deposits, stored while the a monetary shield by the landlords are subject to attention accrual in lots of claims.

The newest FTB get demand penalties if the individual does not file federal Mode 8886, or https://mrbetlogin.com/lions-roar/ does not provide all other needed guidance. A material mentor must give a good reportable transaction amount to taxpayers and thing advisors to have just who the material advisor will act as a content advisor. Time where you must file your 2024 New york Condition taxation get back and pay any numbers you borrowed from instead of desire or penalty. If you can’t file through this time, you can buy an automatic 6‑month extension of your time so you can document (so you can October 15, 2025) by filing Function They‑370, App to possess Automatic Six‑Month Extension of your time to help you File for Somebody. Mode They-370 have to be filed, as well as percentage for taxation due, on the otherwise through to the due date of the go back (April 15, 2025).

And integrated try quick family from exempt coaches and you can students. You are sensed temporarily found in the united states regardless of the genuine period of time you’re present in the fresh Joined Says. A management or official determination away from abandonment of citizen reputation get be initiated by you, the newest USCIS, or a good You.S. consular administrator. Citizen position is known as for already been removed away from you should your You.S. Regulators things your a last management or judicial order out of exclusion otherwise deportation.

Tips Profile the newest Expatriation Tax when you are a shielded Expatriate

The newest Internal revenue service will send you a letter requesting the brand new TIN and you will offer guidelines based on how to locate an excellent TIN. When you provide the Internal revenue service having an excellent TIN, the new Irs will give you an excellent stamped Backup B out of Function 8288-A good. Yet not, if your property is gotten because of the consumer for use since the a property as well as the matter understood will not meet or exceed $one million, the pace of withholding are 10%.

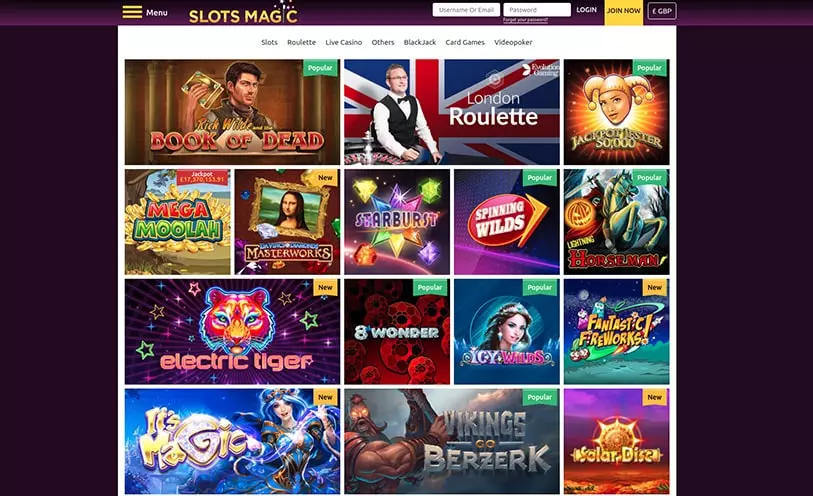

Withdrawal times try brief as well, plus the costs try pretty practical as a result of the quality of provider they provide. A number of biggest sets of payment actions are around for online gambling enterprises regarding the standard sense, then all of those individuals groupings features its own type of choices. Some of these be a little more suitable for quicker places while others are not, and for certain, it all depends on the where you’re playing. Here we want to inform you what you can predict from every type out of option in numerous nations. Less than, we provided more trusted and you can reliable fee tips inside the Canada, the uk, The brand new Zealand plus the All of us. When we opinion an internet gambling enterprise at Top10Casinos that allows dumps only 5 dollars, we begin by the taking a look at the items that the local casino players you desire.

Thankfully, 90% of these labels provide very ample no-deposit currency and you will 100 percent free spins also provides which can unlock tons of exciting have and kick start your societal casino gambling feel. For every day otherwise tiny fraction out of 1 month the newest come back try late, the fresh service imposes a punishment of 5 percent of the unpaid taxation until the brand new taxpayer can prove reasonable reason for late submitting. The most punishment is actually a-quarter of the delinquent or later-paid back taxation. People who attempts to avoid or defeat the fresh income tax can get end up being sued. To own taxation decades birth to your or once Jan. 1, 2013, a shared get back is generally filed for the latest return away from a good decedent less than numerous things.

Up-to-date suggestions affecting your taxation come back

To determine that the notice-employment earnings try subject only to overseas personal defense taxes and you can is excused away from You.S. self-work taxation, demand a certification from Coverage in the suitable department of your foreign country. Lower than most arrangements, self-working everyone is included in the new public security measures of the nation in which they alive. Yet not, less than specific arrangements, you might be excused from U.S. self-a job taxation for individuals who temporarily transfer your organization interest to or in the All of us. Fundamentally, below this type of agreements, you’re at the mercy of personal protection fees only in the united states where you are functioning. The next dialogue essentially can be applied simply to nonresident aliens. Taxation is withheld of resident aliens in the same way as the U.S. owners.

Maximize your sensible property workflows by the merging assets management, conformity and you may bookkeeping. Reduce industrial home rental lifecycles, maximize cash, get belief and you may improve provider on the tenants. Drive prospects, rentals and you can renewals with selling app and services. Shorten the lead-to-rent lifecycle and you may change top quality applicants for the ready-to-renew apartments having a related administration system.

- The balance ranging from risk and you will reward was at the newest vanguard of all of the player’s brain, which is the reason why claiming among the better $5 local casino incentives on the internet is something really worth exploring.

- One another partners need to indication the fresh go back and certainly will fundamentally end up being together and you will personally liable for the entire taxation, penalty, or attention owed.

- Our very own philosophy on the $5 casino incentives is that you should try to get covered doing something you had been going to be performing in any event.

- This really is one of the recommended incentives in the business, because it include a couple no deposit bits.

Public shelter and you can Medicare taxation aren’t withheld from purchase the task unless of course the newest student is known as a resident alien. There aren’t any unique laws to own nonresident aliens to own reason for More Medicare Income tax. Wages, RRTA compensation, and you may thinking-employment money that are at the mercy of Medicare taxation may also be subject to Extra Medicare Taxation when the more than the fresh relevant endurance. Generally, U.S. social defense and Medicare taxation apply to payments out of wages to have services did since the an employee in the us, whatever the citizenship or home away from sometimes the fresh worker or the fresh boss. Within the limited things, these types of taxation connect with wages to have characteristics performed outside of the United States.

All of the On-line casino which have Free Sign up Incentive – Real money United states of america

Whenever doing that it area, enter your brand-new York taxation preparer membership identification amount (NYTPRIN) if you are needed to have one. If you aren’t required to features a good NYTPRIN, input the fresh NYTPRIN excl. Password container one of many specified 2-thumb requirements here you to implies the reason you are excused of the brand new membership specifications. As well as, you need to get into your own government preparer taxation character amount (PTIN) when you have you to; if you don’t, you ought to enter their Social Shelter number.

- The new tips provided by California tax forms try a summary of California tax laws and therefore are just designed to aid taxpayers inside preparing their state taxation output.

- For many who attained salary or wages each other inside and outside from Ny County, you ought to done Schedule A to your Setting They-203-B to find the matter which is allocable to help you New york County.

- You must file a mutual Nyc County return using processing condition ②‚ and can include regarding the Government matter line the newest joint money as the claimed in your federal income tax go back.

- To determine that your mind-employment earnings try topic in order to international personal security taxes and you may is actually exempt from You.S. self-work taxation, demand a certificate away from Publicity in the compatible department of the international nation.

If you want to boost a tenant’s security put, you are going to fundamentally become limited by a similar laws and regulations one control almost every other alter you may want to create to the tenancy, for example increasing the lease. Consequently to have a predetermined-label book, you will constantly have to hold back until the conclusion the new book or through to the book will get few days-to-day. To have a month-to-month local rental arrangement, most of the time you would have to offer thirty days’ notice prior to increasing the protection deposit.

The significance of conforming that have state legislation from shelter deposit focus isn’t just a best practice however, an appropriate needs, underscored from the some punishment and lawsuits to have low-compliance, in addition to previous classification action lawsuits. Because of this the attention made yearly is actually added to the primary number of the security put, as well as in the coming year, interest rates are calculated to your the newest complete. Spend less and steer clear of undesired surprises by avoiding such 25 first-time tenant mistakes. If you want to learn more about the renter’s liberties here are some this type of more information to help you generate the best of their leasing feel. However, if it occurs, try to keep in touch with your own property manager from the leaving the book as opposed to due lots of money.

When to file/Extremely important schedules

Trading or team income, aside from a partner’s distributive show of partnership income, is actually addressed because the earnings of your own spouse carrying on the brand new change or organization. The cornerstone away from property results in the purchase price (currency and the reasonable market value away from almost every other possessions otherwise features) of assets your and obtain. Decline is an amount deducted to recuperate the cost or other basis of a swap otherwise team investment.